So we've lost the concession of packages up to £50 being exempt.

Pinball info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OP

OP

Deleted member 2463

That was the dream sold at the referendum. The reality is no quotas and no tariffs which is not the same as no barriers.

well not really. There are no barriers, there is procedure and the EU are bringing in similar tax avoidance measures for those outside the EU, and this is something that changed post Brexit, but lets not get the facts in the way of some good progaganda!

Regards,

Neil.

OP

OP

Deleted member 2463

For VAT that went years ago. For duty its still there.So we've lost the concession of packages up to £50 being exempt.

OP

OP

Deleted member 2463

I predict when the noise has settled that PU will add the UK back in. Meanwhile everything they get is from the USA already and I order direct from the USA in any way. Best prices that way.

Neil.

Neil.

Hopefully US will have free trade deal with UK so hoping that for future.

On PU Parts UK not listed as others stated, when you try and complete your basket

On PU Parts UK not listed as others stated, when you try and complete your basket

I hear where you’re coming from, but we can’t currently order new Sterns from the EU as the anti-competitive measures no longer apply, can’t order parts due to new red tape making it non-viable for small businesses and @Alpha1 now has to pay duties on his imported used games from

Europe (can’t recall which one of the top of my head, but it’s on another thread). These, to me, are barriers to trade.

If I’m getting something wrong, or misunderstanding, please correct me,but it’s a bit off to paint it as propaganda. We really must try and move away from polarising debate and insulting people with a different understanding.

Europe (can’t recall which one of the top of my head, but it’s on another thread). These, to me, are barriers to trade.

If I’m getting something wrong, or misunderstanding, please correct me,but it’s a bit off to paint it as propaganda. We really must try and move away from polarising debate and insulting people with a different understanding.

OP

OP

Deleted member 2463

I hear where you’re coming from, but we can’t currently order new Sterns from the EU as the anti-competitive measures no longer apply, can’t order parts due to new red tape making it non-viable for small businesses and @Alpha1 now has to pay duties on his imported used games from

Europe (can’t recall which one of the top of my head, but it’s on another thread). These, to me, are barriers to trade.

If I’m getting something wrong, or misunderstanding, please correct me,but it’s a bit off to paint it as propaganda. We really must try and move away from polarising debate and insulting people with a different understanding.

just pulling your leg mate but I agree -> you first

That was the dream sold at the referendum.

its not viable for **** poor run small businesses, I buy tons of stuff from one-man-bands to large outfits in the US and they all manage this, China too.

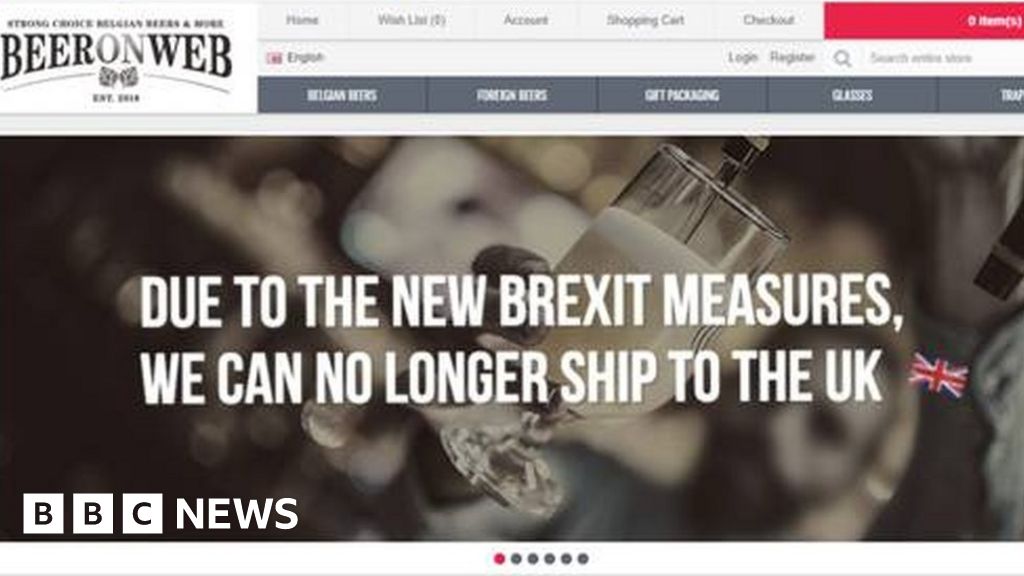

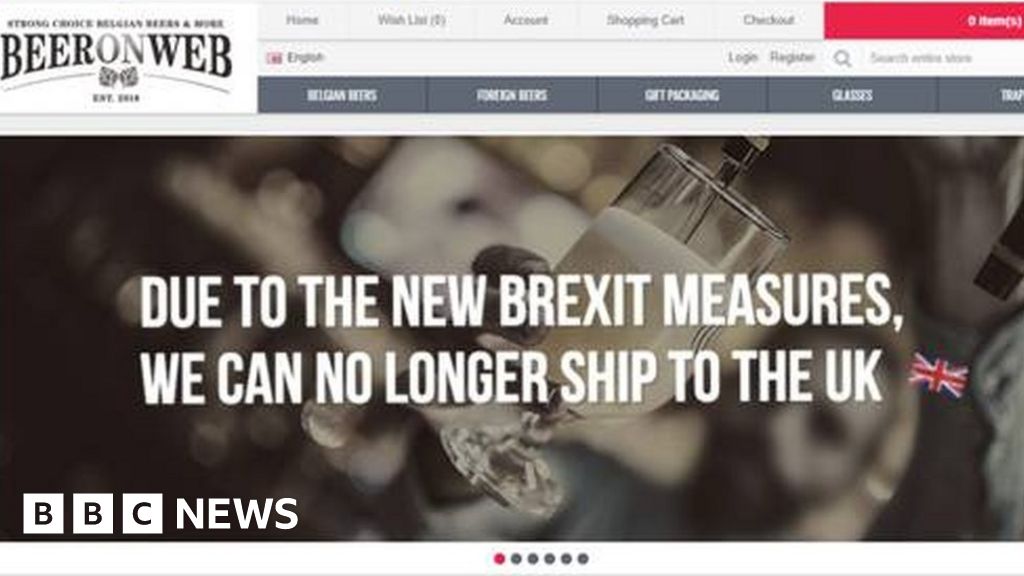

EU firms refuse UK deliveries over Brexit tax changes

Some EU specialist firms stop delivering to the UK because of tax changes that took effect on 1 January.

www.bbc.co.uk

EU firms stop UK deliveries over Brexit tax change - BBC News

Some EU specialist firms stop delivering to the UK because of tax changes that took effect on 1 January.

Sent from my Atari 2600

The night is always darkest before the dawn

- Joined

- Jul 21, 2011

- Messages

- 366

I don't think we can completely blame the UK government. Looking at Dutch Government site it looks like the £135 is the equivalent of €150. Had no deal been made then goods up to €150 attract local VAT and above are liable to VAT and any import duty. I suspect that if the UK have this requirement for seller to register for UK VAT then the EU will expect the same however the Dutch site hasn't been updated to cover the EU-UK deal yet.

David

David

waynej4

Registered

Surely the headline should be:

"EU firms refuse UK deliveries over Tax changes" ?

While it is a consequence of Brexit, and taking back control of our own rules and laws, it affects all countries does it not? Not just EU countries!?

Is it not a good thing for the UK to ensure all taxes are collected where due? is it not fair on local businesses that there is a level playing field with regards the collection of taxes?

Having said the above, I do agree with comments on here that the implementation does seem a bit Kak-handed!

"EU firms refuse UK deliveries over Tax changes" ?

While it is a consequence of Brexit, and taking back control of our own rules and laws, it affects all countries does it not? Not just EU countries!?

Is it not a good thing for the UK to ensure all taxes are collected where due? is it not fair on local businesses that there is a level playing field with regards the collection of taxes?

Having said the above, I do agree with comments on here that the implementation does seem a bit Kak-handed!

OP

OP

Deleted member 2463

just looking I spent almost 2600 with them last year. probably more than most. would be interesting to know how much of their business is in the UK, must be tiny.

- Joined

- Jul 21, 2011

- Messages

- 366

It wouldn't surprise me if the same scheme is in place for sales to EU but we haven't heard about it yet. If US companies have to do the same with sales to individuals in the EU then that could be the end for sales to UK and EU individuals. There would be an opportunity for a company to buy for individuals but that makes it more expensive for those individuals.Surely the headline should be:

"EU firms refuse UK deliveries over Tax changes" ?

While it is a consequence of Brexit, and taking back control of our own rules and laws, it affects all countries does it not? Not just EU countries!?

Is it not a good thing for the UK to ensure all taxes are collected where due? is it not fair on local businesses that there is a level playing field with regards the collection of taxes?

Having said the above, I do agree with comments on here that the implementation does seem a bit Kak-handed!

Webuyanythingforindividuals.com

I‘m not a tax expert but in the Beeb article it says “The moves follow changes in VAT rules brought in by HM Revenue and Customs on 1 January.” so pretty sure it’s just us.It wouldn't surprise me if the same scheme is in place for sales to EU but we haven't heard about it yet. If US companies have to do the same with sales to individuals in the EU then that could be the end for sales to UK and EU individuals. There would be an opportunity for a company to buy for individuals but that makes it more expensive for those individuals.

Webuyanythingforindividuals.com

I want to put an order for plastics in to Ministry of Pinball or Pinball Center, I’ve just emailed them asking if they are currently shipping small value orders to the UK....

OP

OP

Deleted member 2463

interestingly I've ordered from two other EU based pinball sellers so PU lost out on £500 odd quid of business.

Well whatever the situation is, it’s clearly been poorly communicated both to UK customers and global businesses.

Perhaps it was due to the discussions being pushed to, and past, final deadlines, so maybe more communications are coming, but I’m not holding my breath.

Perhaps it was due to the discussions being pushed to, and past, final deadlines, so maybe more communications are coming, but I’m not holding my breath.

- Joined

- Jul 21, 2011

- Messages

- 366

HMRC may have made changes in line with EU, I guess we will need to wait and see. Plenty of time as we will be entering lockdown soon.I‘m not a tax expert but in the Beeb article it says “The moves follow changes in VAT rules brought in by HM Revenue and Customs on 1 January.” so pretty sure it’s just us.

I want to put an order for plastics in to Ministry of Pinball or Pinball Center, I’ve just emailed them asking if they are currently shipping small value orders to the UK....

You’d hope so David, otherwise it’s quite unfathomable.HMRC may have made changes in line with EU, I guess we will need to wait and see. Plenty of time as we will be entering lockdown soon.

waynej4

Registered

I'm not sure it's about poor communication. They knew about it, they just don't want to implement it.

And I can sympathise with them - keeping track of UK regulations/taxes etc for a small business is probably something they can do without! Imagine if all other 194 countries had similar rules!

Don't other countries apply taxes and duties at their borders?

And I can sympathise with them - keeping track of UK regulations/taxes etc for a small business is probably something they can do without! Imagine if all other 194 countries had similar rules!

Don't other countries apply taxes and duties at their borders?

OP

OP

Deleted member 2463

If freaking China can do it then anyone can do it. Changes similar to this are coming to the EU also, read the EU VAT Directive.

Neil.

Neil.

- Joined

- Jul 21, 2011

- Messages

- 366

I presume the UK is just first to implement. It could make shipping to individuals very expensive for both sides.If freaking China can do it then anyone can do it. Changes similar to this are coming to the EU also, read the EU VAT Directive.

Neil.

David

OP

OP

Deleted member 2463

wait until you start shipping to Northern Ireland, which is the only part of this that stinks.

Simply put the government and the EU are closing a tax hole that we've benefited from for years. But the paperwork is easily systemisable, I've done it for a couple of other businesses I'm involved in.

Simply put the government and the EU are closing a tax hole that we've benefited from for years. But the paperwork is easily systemisable, I've done it for a couple of other businesses I'm involved in.

I’ve got 2 parcels from China coming tomorrow, I have always avoided charges with packages from HK so I will report back tomorrow what happens.Can someone please clarify the following

re Pinball Universe. I understand they are in Germany and the trade deal between the EU and the UK was 'no barriers'?

Re GPE; does the £135 rule mean that China will have to collect VAT before it can ship to the UK? That's never going to happen.

What about other countries around the world but not in the EU; will they be collecting VAT on behalf of the UK Govt?

I has a pakage arrive today from the USA.

Ordered 29/12 and charged VAT

Ordered 29/12 and charged VAT

- Joined

- Jul 21, 2011

- Messages

- 366

and handling charge I presume.I has a pakage arrive today from the USA.

Ordered 29/12 and charged VAT

waynej4

Registered

I would have thought that this is normal, not to do with this change in implementation of the VAT collection.I has a pakage arrive today from the USA.

Ordered 29/12 and charged VAT

for orders placed from 1/1/21 under £135 you should be charged vat by the overseas supplier. over that amount you will get the vat to pay on arrival plus the dreaded royal mail/dhl et al. “admin fee”

works out better to pay the vat up front and avoid the extra admin fee.

just be thankful for all those orders you got away without paying the right vat for years.

Sent from my iPhone using Tapatalk

works out better to pay the vat up front and avoid the extra admin fee.

just be thankful for all those orders you got away without paying the right vat for years.

Sent from my iPhone using Tapatalk

So what's the difference between VAT and duty?

Sent from my SM-G960F using Tapatalk

Sent from my SM-G960F using Tapatalk