It's only for my export, my import is just normal price capCareful with agile, my mate's on it and it flat-topped at 58p import.

Better off doing nothing and wait to see what happens in Oct

Pinball info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

National Grid’s Electricity System Operator (ESO) was forced to pay £9,724.54 per megawatt hour to Belgium, more than 5,000% higher than the typical price

www.itv.com

www.itv.com

London narrowly avoided power blackout as electricity prices surged in heatwave | ITV News

A sequence of issues around the hottest UK days on record led to extreme constraints in the power system and hiked up demand. | ITV News London

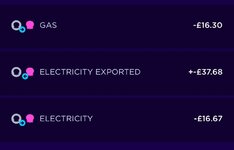

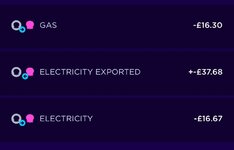

This months energy bill + 16 days of export. (sun went a bit **** since the heat wave, bit cloudy, but panels still covered our load just did not export much in last week)

I have room for extra panel on my power roof so really tempted to add an extra 400w panel to make the system a 5.2 from 4.8 as its such easy access should not cost much to install. Just need to check the inverter is not already maxed out and can accept another 400w. I am also very tempted to buy another 5.8kw battery as the current one will cover our evening power perfectly, but need to be a little careful how we use power ie dont go running washing machines or putting oven on for hours etc.. but if we had another 5.8kw battery we could quite easily have a nice roast dinner in the evening and still have plenty left over to cover the night etc.. Would just make it a bit easier. Getting a slave battery is a bit cheaper then the master as well and there is room for one more in garage loft so would work out well. Just need to look into costs...

Also can't wait to get a full 12 months worth of data to see how it performs all year round, I find the data super interesting will all these price hikes we are getting I feel jumping on the solar bandwagon was the right decision and think i got in there just Intime.

will all these price hikes we are getting I feel jumping on the solar bandwagon was the right decision and think i got in there just Intime.

I have room for extra panel on my power roof so really tempted to add an extra 400w panel to make the system a 5.2 from 4.8 as its such easy access should not cost much to install. Just need to check the inverter is not already maxed out and can accept another 400w. I am also very tempted to buy another 5.8kw battery as the current one will cover our evening power perfectly, but need to be a little careful how we use power ie dont go running washing machines or putting oven on for hours etc.. but if we had another 5.8kw battery we could quite easily have a nice roast dinner in the evening and still have plenty left over to cover the night etc.. Would just make it a bit easier. Getting a slave battery is a bit cheaper then the master as well and there is room for one more in garage loft so would work out well. Just need to look into costs...

Also can't wait to get a full 12 months worth of data to see how it performs all year round, I find the data super interesting

Jib

Site Supporter

Last year we moved to a new house and for the first time we’re properly considering solar panels. Previously we’ve either not been convinced on the return or we didn’t think we’d be staying at the house long enough for it to be worth it. We’re finally somewhere we know we want to stay 20+ years as long as our circumstances don’t dramatically change.

I think a lot more people will be looking into solar like us but the initial cost can still be off putting. We still have a mortgage so it’s thinking about where that money is best spent considering interest rates are going up too.

I think a lot more people will be looking into solar like us but the initial cost can still be off putting. We still have a mortgage so it’s thinking about where that money is best spent considering interest rates are going up too.

I just can’t see the £ payback at the moment, unless you factor in doing your bit to save the planet.

Really, even with the current energy prices?I just can’t see the £ payback at the moment, unless you factor in doing your bit to save the planet.

I just can’t see the £ payback at the moment, unless you factor in doing your bit to save the planet.

Really, even with the current energy prices?

I agree... Over the LONG term i can see a reasonable Roi, however at (taking at worst case Colin's example) between 10k and 17K investment Vs max 26p per KWH... Verses the lifespan of the equipment... I just cant see it...

With my system since the start of the year Ive saved £450 and exported about £210 worth at the standard rate at the time (no feed in as DIY so save more by using it), would have saved more so far if my lithium battery was in place earlier but wasnt setup until early June.

Last year when pricing up I predicted my system would be paid off in less than 5 years, I actually understimated how much I would produce during summer but also understimated how much I would loose to export, but with the higher unit prices its still under 5 years.

Dont forget from October 1st unit price is going up to over 40p KWh predicted and up again on 1st January when it switches to 3 months change.

Funnily though my savings from 1st October would have been higher if I hadnt fixed at a rate lower than the current predicted price cap.

Last year when pricing up I predicted my system would be paid off in less than 5 years, I actually understimated how much I would produce during summer but also understimated how much I would loose to export, but with the higher unit prices its still under 5 years.

Dont forget from October 1st unit price is going up to over 40p KWh predicted and up again on 1st January when it switches to 3 months change.

Funnily though my savings from 1st October would have been higher if I hadnt fixed at a rate lower than the current predicted price cap.

Last edited:

Everyone's situation is different. But for me (paying 28.5p currently) and that's going up 65% in oct most likely I feel they will pay for them self far quicker then they would before all this energy price ****e. Also the way my heating works I can pretty much turn off Gas over summer months as well so is huge gas savings as well. I really want to see it after 12 months so I can sit back and really see how it performs year round then get a clear idea of savings / ROI timeline etc..

I have no concerns my system will be working past the point it pays itself off. There are many here who have ten year old systems and most failures are a single replaceable component not the entire system. A panel stops working, the battery has reduced capacity, the inverter bricks itself (is replaceable). The lifetime of the equipment doesn’t bother me, it is all tried and tested

Having these systems open up schemes being run by firms like Octopus, who are changing the way we buy and use energy. I have more options available like variable selling rate, variable buying rate or use my battery for grid storage. All of which increase the ROI.

I also no longer break into a panic when I hear about price increases. I want to break our dependency on 3rd parties who do not have the same interests as us.

Then there is the environment, each person can put their own value on that but my motivation wasn’t just money but sustainability.

Having these systems open up schemes being run by firms like Octopus, who are changing the way we buy and use energy. I have more options available like variable selling rate, variable buying rate or use my battery for grid storage. All of which increase the ROI.

I also no longer break into a panic when I hear about price increases. I want to break our dependency on 3rd parties who do not have the same interests as us.

Then there is the environment, each person can put their own value on that but my motivation wasn’t just money but sustainability.

Just realised I could be putting my £65 per month broadband expenses through the company name, doh!!

And mobile phoneJust realised I could be putting my £65 per month broadband expenses through the company name, doh!!

And £312 WFH expenses. So that's over a grand right there. Unfortunately I'm too good at ****ing money away.And mobile phone

OP

OP

Deleted member 2463

how does it help you by putting it through the company?

1) less company tax to payhow does it help you by putting it through the company

2) cash comes from company account not personal

Quite a few reasons it would help you

OP

OP

Deleted member 2463

so looking at what people are paying here I'd put the average payback at 15 years even at todays energy rates and assumes that the battery doesn't need to be replaced; which I'd put money on it will need to be (Tesla might be the best choice given the warranty).

Neil.

Neil.

How is it a tax dodge if you use your mobile phone and internet for company use? It’s literally what company expenses are for.ah ok, so purely to dodge paying tax? and assume you take cash out of the company via dividend?

One of the FEW pros of running your own companies.1) less company tax to pay

2) cash comes from company account not personal

Quite a few reasons it would help you

Pay less tax YES! HELL YES!

October is as everyone knows going to bring us more costs....

Then apparantly I heard on the radio today that it looked as if Janurary would be more rises.

Shocking.

We need hydro as an energy source.

OP

OP

Deleted member 2463

How is it a tax dodge if you use your mobile phone and internet for company use? It’s literally what company expenses are for.

well thats what I'm asking? are you paying VAT? I'd guess not so its a tax dodge. Are you telling me you never make a personal call or browse pinball info on your "work" phone and internet?

OP

OP

Deleted member 2463

One of the FEW pros of running your own companies.

Pay less tax YES! HELL YES!

October is as everyone knows going to bring us more costs....

Then apparantly I heard on the radio today that it looked as if Janurary would be more rises.

Shocking.

We need hydro as an energy source.

paying less tax sadly doesn't stop the government from spending money, its an I'm alright Jack. If everyone did it...

I never said I did any of this, u asked how it helps and I told you how.

VAT has nothing to do with it so no idea why you bring that up. And yes your allowed to use company assets for personal stuff occasionally. The tax man ain’t gonna smash down your door for browsing this site on a work phone.

For some ppl here this site is work related.

VAT has nothing to do with it so no idea why you bring that up. And yes your allowed to use company assets for personal stuff occasionally. The tax man ain’t gonna smash down your door for browsing this site on a work phone.

For some ppl here this site is work related.

I don’t earn enough to pay tax being mostly retired nowadays. That said the wife has been paying enough for the two of us this past 20yr plus albeit her business seems to have gone to rats since lockdown and sadly has failed to recover

Hey ho I can always flog a pin or two if needs must, maybe or possibly not.

Hey ho I can always flog a pin or two if needs must, maybe or possibly not.

Sorry to hear thatI don’t earn enough to pay tax being mostly retired nowadays. That said the wife has been paying enough for the two of us this past 20yr plus albeit her business seems to have gone to rats since lockdown and sadly has failed to recover

Hey ho I can always flog a pin or two if needs must, maybe or possibly not.

Let’s hope she never phoned you off her company phone as that would upset hall monitor Neil! And would be “tax fraud”

@Neil McRae - all my tax is 100% legit, legal and paid up. Not that it is any of your (or anyone elses) business.

If anyone wishes to report me then get in touh and will pass on all my details to make the IRs job easier to look me up. Someone did this not long ago and I spend a couple of hours in an office drinking coffee with two nice people - telling me I actually wasnt claiming enough on a few things.....

On the solar panel route @russdx1

Coming from an electrical and electronic background - I would not go down the solar panels route. Takes years to get your money back and I do not want the expense now. My gas & electric was £80 a month. In October it will be double that I would imagine. I can live with that. Especially with the money I get back legit thru my business.... You never know the UK government may step in with a plan (yes I know how stupid that sounds bud).

I really also do not like the idea of all the lithium mining for batteries. If you consider yourself as green I would not be looking at that. However I would be a total hypocrite and would love to own a tesla.....

I do not have any magic solutions, I wish I did. Like I previously stated hydrogen would be my longer term bet. But it is very hard to extract H2 from H2O.

If anyone wishes to report me then get in touh and will pass on all my details to make the IRs job easier to look me up. Someone did this not long ago and I spend a couple of hours in an office drinking coffee with two nice people - telling me I actually wasnt claiming enough on a few things.....

On the solar panel route @russdx1

Coming from an electrical and electronic background - I would not go down the solar panels route. Takes years to get your money back and I do not want the expense now. My gas & electric was £80 a month. In October it will be double that I would imagine. I can live with that. Especially with the money I get back legit thru my business.... You never know the UK government may step in with a plan (yes I know how stupid that sounds bud).

I really also do not like the idea of all the lithium mining for batteries. If you consider yourself as green I would not be looking at that. However I would be a total hypocrite and would love to own a tesla.....

I do not have any magic solutions, I wish I did. Like I previously stated hydrogen would be my longer term bet. But it is very hard to extract H2 from H2O.

FFS Neil, get off your high horse. It's a legitimate company expense which I'm currently paying out of my personal money. The costs of running a business are meant to be accounted for on the books and deducted from profits before corporation tax. It's not a tax dodge.... it's literally how a company is meant to balance the books. The government get plenty of money from me don't worry and yes I pay VAT and am VAT registered. Every time I mention company expenses you jump on it as though I'm some sort of Premier League football player hiding all my money in offshore accounts or something. I'm simply trying to work out what should legitimately go through the company instead of out of my own pocket. Most of my electricity bill is from running two big desktop PC's and 6 monitors night and day. It would be nice to be able to claim back the actual amount of money they use, but I've never claimed a penny over the years. Turns out I could as a minimum claim £312 per year towards it.ah ok, so purely to dodge paying tax? and assume you take cash out of the company via dividend?

Anyway, the benefit in case it still isn't clear is that you pay corporation tax on profit and if you're not deducting the expenses of running that business then you're not going to be in business very long.

The *******Someone did this not long ago and I spend a couple of hours in an office drinking coffee with two nice people - telling me I actually wasnt claiming enough on a few things.....

Same here, I’m an electrician with plenty of roof area for panels but just can’t do it. We have cut our usage down, 2 kids left and 2 at uni but me at home all day trying not to drink beer until 6pm

My bro just picked up a new Tesla and loves it, only had to charge from home so far. Lives in London and only has to go up to Luton and local.

But electric cars are not the answer due to the batteries/lithium like you say.

FFS Neil, get off your high horse. It's a legitimate company expense which I'm currently paying out of my personal money. The costs of running a business are meant to be accounted for on the books and deducted from profits before corporation tax. It's not a tax dodge.... it's literally how a company is meant to balance the books. The government get plenty of money from me don't worry and yes I pay VAT and am VAT registered. Every time I mention company expenses you jump on it as though I'm some sort of Premier League football player hiding all my money in offshore accounts or something. I'm simply trying to work out what should legitimately go through the company instead of out of my own pocket. Most of my electricity bill is from running two big desktop PC's and 6 monitors night and day. It would be nice to be able to claim back the actual amount of money they use, but I've never claimed a penny over the years. Turns out I could as a minimum claim £312 per year towards it.

Anyway, the benefit in case it still isn't clear is that you pay corporation tax on profit and if you're not deducting the expenses of running that business then you're not going to be in business very long.

It would not surprise me if Neil dodges more tax than anyone else on this forum

Just ignore the scare mongering garbage.

Hopefully you have planning permission for your bins outside your house or that will be the next thing your accused of

OP

OP

Deleted member 2463

@Neil McRae - all my tax is 100% legit, legal and paid up. Not that it is any of your (or anyone elses) business.

One of the FEW pros of running your own companies.

Pay less tax YES! HELL YES!

You post above about paying less tax and then say the above.

honestly mate **** right off.