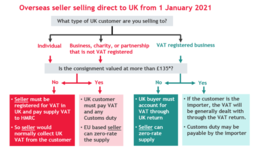

Agreed, UK law does not apply outside the UK, but supply of goods to the UK is subject to UK law and if an overseas supplier chooses to supply goods to the UK they must comply with UK laws in respect of supply of those goods in the UK.

The law in this case is the Value Added Tax Act 1994 Part I Supply of Goods and Section 7 of that law defines when goods are supplied in the UK and if any supplier chooses to supply goods to the UK they have to comply with UK laws, regardless of where they are located. In the case of supplying goods to the UK that includes registering for and charging UK VAT on goods they choose to supply to the UK that are valued less than £135, wherever in the world they are located.

Explains why various overseas suppliers have minimum order size greater than £135 or simply can't be bothered supplying to the UK.

The law in this case is the Value Added Tax Act 1994 Part I Supply of Goods and Section 7 of that law defines when goods are supplied in the UK and if any supplier chooses to supply goods to the UK they have to comply with UK laws, regardless of where they are located. In the case of supplying goods to the UK that includes registering for and charging UK VAT on goods they choose to supply to the UK that are valued less than £135, wherever in the world they are located.

Explains why various overseas suppliers have minimum order size greater than £135 or simply can't be bothered supplying to the UK.