BigIan the predicted unemployment increase is due to a fall in Aggregate Demand. (Not trying to stir thing up, just replying to your query)

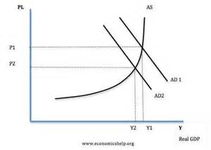

View attachment 32445

Generally Economists think that the Economy works as in the diagram above . Aggregate Demand is basically the total demand in the Economy, consisting of AD= C+ I+ G+ (X-M) Consumption + Investment + Government spending + Exports - Imports.

Out of all these factors Consumption is by far the largest.

A falling pound would actually boost AD as exports would rise and imports would fall. (this would boost real GDP and employment)

However, this effect is minor compared to the impact of a decrease in consumption on an Economy. Investment will almost certainly fall as non-EU investors look to invest within the Union instead, Government Spending will fall (If corporation tax is reduced to 15% then this loss has to be made up by either increased income tax etc or a reduction in public spending).

The net result is to shift AD inwards which causes a fall in real GDP/employment. (Real GDP is essentially linked to employment which is why you can read employment as position Y on the graphs)

The big shift though is about Consumption which is why an cut in interest rates is likely to reduce people's incentives to save. Is it going to work though? Interest rates are already at record lows. Availability of credit is also a major factors. Banks won't lend to people unless they are certain they can get the money back.

In addition to the change to demand there is also a supply side hit.

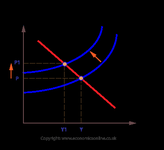

View attachment 32446

Aggregate supply is largely driven by the costs of producing goods. The UK is a big importer of commodities such as Oil and Wheat. These prices are generally sold in US dollars. A decrease in the strength of the pound will cause production costs to increase and again this will cause a decrease in national income / employment. (And inflation, Oil prices are already rising, Wheat will follow shortly but is also subject to large variations due to harvest yields etc)

In terms of inflation a drop in AD will actually cause prices to fall, however the fall in AS will cause prices to rise. The net result will depend on which factor is biggest.

However, both a decrease in AS and a decrease in AD will trigger a rise in unemployment.

Expectations are also very important to the final result. Both Consumption and (Business) Investment are very driven by future predictions. Effectively talking yourself into a recession or growth. The initial changes are also then subject to both a multiplier effect (which is very powerful) and an accelerator effect where a change in investment causes further changes to the speed of changes in the Economy.

Essentially this is the Economic explanation as to why shocks etc are likely to lead to an increase in unemployment. There are very few economists in favour of Brexit. The extent of the supply side shock will determine the damage done to the UK economy. A falling pound will be bad but hopefully not anything like to the same extent of the OPEC price rises in the 70s

Trade is also a very complex thing. Trade barriers are almost certainly not in the interest of either nation. However, this is often a very hard thing to convince people of when they see traditional industries undercut by foreign companies. The recent Tata Steel situation brought this to light when the UK was unable to subsidies their production.