No, i just don't give a **** what that clown says on anything and wouldn't believe anything he says either.^^ I think your misunderstanding the point. He wasn’t annoyed that Stern employees were getting discounted pins. He was relaying the fact that Stern could still turn a very small profit, on selling pins to staff at the price point.

Pinball info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

To be fair, he’s been accurate on a whole bunch of stuff.No, i just don't give a **** what that clown says on anything and wouldn't believe anything he says either.

He’s live just now, you can ask him direct if you like?To be fair, he’s been accurate on a whole bunch of stuff.

Believe none of what you hear and half of what you see.

Last edited:

I have no interest in what Stern sell a pinball to an employee for.

I used to buy musicman guitars thru the uk importers and they used to give them out less than cost. It was a part endorsement deal. As pointed out it was done as good will. We also had to sign an agreement to say we couldn’t sell it within a year.

The trouble is nobody considers:

Stern want to make money - most goods you buy cost ⅓ of the retail price to actually manufacture.

In the uk we have to pay vat when it lands.

You want a decent warranty. That costs the retailer. If a node board fails say after 16 months then it costs the retailer

I used to buy musicman guitars thru the uk importers and they used to give them out less than cost. It was a part endorsement deal. As pointed out it was done as good will. We also had to sign an agreement to say we couldn’t sell it within a year.

The trouble is nobody considers:

Stern want to make money - most goods you buy cost ⅓ of the retail price to actually manufacture.

In the uk we have to pay vat when it lands.

You want a decent warranty. That costs the retailer. If a node board fails say after 16 months then it costs the retailer

So, after 1st Jan does the mugging stop? I've read the 'rules' and can't see any definitive answer.

The implication is 'yes' but there are lots of weasel words, ambiguities and wiggle room.

The implication is 'yes' but there are lots of weasel words, ambiguities and wiggle room.

OP

OP

Deleted member 2463

The UK has no requirement to align to EU tariffs, and currently its pointing towards this tariff going away. @philpalmer I hope you've got the rowers on that boat ready to go!

Another example of why things are just gonna end up more expensive for everyone here after the 1st. Just received a package from fedex with my vat number clearly visible on the shipping docs. Still got charged the magic £12 admin fee as the they prepaid the vat which they didn't need to do, so they just ****ed me for £12 extra which is lost. Of course this is just a small amount and if it was only a couple of times a year then no biggy, but now its gonea be £12 extra on every frikin parcel imported even if you have a vat number and dont have to pay it...

Frikin marvellous , welcome to outside the eu...

Frikin marvellous , welcome to outside the eu...

OP

OP

Deleted member 2463

thats a **** up Jim. They should have done that at all. Nothing Changes until the 1st so they shouldn't have been charging you anything. Did the parcel come from the EU?Another example of why things are just gonna end up more expensive for everyone here after the 1st. Just received a package from fedex with my vat number clearly visible on the shipping docs. Still got charged the magic £12 admin fee as the they prepaid the vat which they didn't need to do, so they just ****ed me for £12 extra which is lost. Of course this is just a small amount and if it was only a couple of times a year then no biggy, but now its gonea be £12 extra on every frikin parcel imported even if you have a vat number and dont have to pay it...

Frikin marvellous , welcome to outside the eu...

Neil.

Surely the £12 admin fee is for the customs declaration and absolutely nothing to do with VAT.Another example of why things are just gonna end up more expensive for everyone here after the 1st. Just received a package from fedex with my vat number clearly visible on the shipping docs. Still got charged the magic £12 admin fee as the they prepaid the vat which they didn't need to do, so they just ****ed me for £12 extra which is lost. Of course this is just a small amount and if it was only a couple of times a year then no biggy, but now its gonea be £12 extra on every frikin parcel imported even if you have a vat number and dont have to pay it...

Frikin marvellous , welcome to outside the eu...

When I worked importing aircraft parts we charged a flat £25 admin fee in every item. We also never took out insurance even if the customer paid for it, rather taking the chance it wouldn't get lost. A fairly substantial risk when some of the items were listed at over 250k.

As an aside the company (GlobalEyes) basically came about from working around duty clauses by arguing against HMRC that certain items for a bin wagon needed recategorising and were eligible for tariff duty payments.

I haven't looked at the specific ruling here, but expect that if a similar challenge was placed against the tariff that it could be argued that pinball machines do not fall under the tariff eligible for 25% duty.

The whole point of duty is to encourage companies to buy local, if you cannot buy that product locally the duty is usually 0%, or at least very low.

Duty is also lower for buying from third world countries to encourage trade with them.

(I will add that it's pushing 15 years since I worked in import/export, but the basic theory of duty won't have changed significantly in that time)

The way USA is handling Covid, it could end up as a third world country in the not too distant future anyway.

No, the charge is from the courier for the ‘admin’ of paying your import vat and charges to the gov, nothing to do with customs forms, which are pre-provided with a valid uk vat number here. Without this they wouldn’t even know what the vat to pay was. Ie you get billed the vat they payed on your behalf and the extra £12. (FedEx is the example here). The vat can be claimed back in the normal way but not the £12, that is lost.Surely the £12 admin fee is for the customs declaration and absolutely nothing to do with VAT.

When I worked importing aircraft parts we charged a flat £25 admin fee in every item. We also never took out insurance even if the customer paid for it, rather taking the chance it wouldn't get lost. A fairly substantial risk when some of the items were listed at over 250k.

As an aside the company (GlobalEyes) basically came about from working around duty clauses by arguing against HMRC that certain items for a bin wagon needed recategorising and were eligible for tariff duty payments.

I haven't looked at the specific ruling here, but expect that if a similar challenge was placed against the tariff that it could be argued that pinball machines do not fall under the tariff eligible for 25% duty.

The whole point of duty is to encourage companies to buy local, if you cannot buy that product locally the duty is usually 0%, or at least very low.

Duty is also lower for buying from third world countries to encourage trade with them.

(I will add that it's pushing 15 years since I worked in import/export, but the basic theory of duty won't have changed significantly in that time)

The way USA is handling Covid, it could end up as a third world country in the not too distant future anyway.

as I said above it’s completely unnecessary for vat registered businesses and just another way for large freight companies to steal from you.

I was just commenting on the reality of what importing goods is like when you do it every day and how its going to be now even more so

Last edited:

What a PITA. reminds me of the joys of working with UPS and Securicor in the late 90s. I don’t think in 10 years I ever had an invoice for the correct amount.

OP

OP

Deleted member 2463

nothing to do with Brexit everything to do with a **** courier company.No, the charge is from the courier for the ‘admin’ of paying your import vat and charges to the gov, nothing to do with customs forms, which are pre-provided with a valid uk vat number here. Without this they wouldn’t even know what the vat to pay was. Ie you get billed the vat they payed on your behalf and the extra £12. (FedEx is the example here). The vat can be claimed back in the normal way but not the £12, that is lost.

as I said above it’s completely unnecessary for vat registered businesses and just another way for large freight companies to steal from you.

I was just commenting on the reality of what importing goods is like when you do it every day and how its going to be now even more so

[/URL]

I'm not sure Im any the wiser really.

Seems to talk more about importing as a punter rather than if you're a business which is good.

I'm not sure Im any the wiser really.

Seems to talk more about importing as a punter rather than if you're a business which is good.

- Joined

- Oct 21, 2013

- Messages

- 2,294

@Neil McRae The slaves are ready to row, loading early Jan!!!

So are we all good now to order from the USA?

I'm getting heat in the style of... where the hell is the Stranger Things UV kit!

I'm getting heat in the style of... where the hell is the Stranger Things UV kit!

Was in stock last time a looked at little shop of games premium le onlySo are we all good now to order from the USA?

I'm getting heat in the style of... where the hell is the Stranger Things UV kit!

I have a shop that has one, just wanna check b4 hitting the big button.

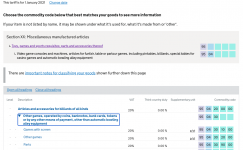

Why did I order that automated bowling machine DOH!!!View attachment 128895

No more ambigous wording, get out clauses or tripe. Just good old fashion, this is VAT, this is the duty. Happy flipping friends.

Guess the slaves are taking a bit of trainingThe UK has no requirement to align to EU tariffs, and currently its pointing towards this tariff going away. @philpalmer I hope you've got the rowers on that boat ready to go!

View attachment 128840

Dubi

Registered

I was a Honda motorbike man. Always ended buying Honda but I always looked around and always wanted to like a Triumph but found it hard on a test ride to love them.

Last time round Honda hadn’t done enough to keep me interested and I ended up with a BMW S1000XR. I couldn’t get on the the GS.

The XR is awesome to ride but every time it goes for a service something major happens. They wrote the swing arm off removing the brake callipers on the 1 year service. The fuel pipe was found to be crimped incorrectly to the fuel pump on the second. BMW’s aftercare is legendary and the bikes are a work of mad geniuses but I don’t think the bikes are bullet proof. But then nothing is at the moment.

With apologies for having taken this off thread again, the XR was amongst the bikes I tested before my first GS. I loved its attitude, and hitting it on the motorway had me laughing. But it was just too revvy for me, and I was also disappointed with what I felt was a heavy clutch. I think we're all made for particular bikes, and bikes for us, and after first trying the gs and having ridden the XR, the adv 1290, the XC and MS, as soon as I got back on a GS it was like put on a comfy pair of slippers (or summit, I don't actually own any slippers...).

Have to agree on BMW service. I know you pay for it, but the service I received for the car and bike have always been top-notch. Touch wood, not had any issues but hoping it stays that way.

Looks like this has been resolved for now.. 25% has been dropped

He hasn’t had the stock to sell

It does mean that eu distributor s are now stuck with stuff they have paid 25% more for

It does mean that eu distributor s are now stuck with stuff they have paid 25% more for

If they didn't chose to wait it out like Phil then they've only got themselves to blame...He hasn’t had the stock to sell

It does mean that eu distributor s are now stuck with stuff they have paid 25% more for

The box is a quick shifter, I rarely use the clutchBut it was just too revvy for me, and I was also disappointed with what I felt was a heavy clutch.

I had an R9T scrambler as a demo whilst my bike was serviced last week. I got use to it by the time i returned but getting back in mine felt like a dream. So smooth.

But I am still on the journey back from sports bikes to something more comfortable, that I can ride for hours not minutes.

And the import tax thing is great too.

So will his mean nib pins go back to 6.5k for a pro? Any word on cgc and cactus canyon? a new cgc might even bring som mmr's out of the wood work of the for sale threads.

Pin prices are only going one way and it ain't down!So will his mean nib pins go back to 6.5k for a pro?