We just had a order from ministry of Pinball arrive this morning. (Order value 848 euro). Delivered by the post office with no additional charges at all.

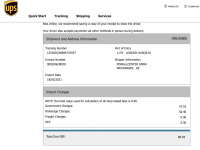

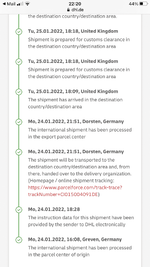

We are expecting a similar size order from pinball center Germany Wednesday from UPS. will update this thread with what happens with that one.

K.

Under the limit, charged in country with repatriation by the seller.

Over the limit, charged here.

Issues will arise if:

- Seller charging and not repatriating - what happens then?

- Seller charging, UK charging - as we have seen happen. Don't forget this compounds over the initial charge, so a 20% charge on a 20% charge is a 44% true uplift.

The magic 44% just happened to me on a 500 euro ministry of pinball order. Not great. I can get the vat back on the uk side, but if you are a private customer and not a vat registered business then this is going to suck even more than it does now. So be careful people! Not even sure you can complain to HMRC once they've charged you wrongly, or even sure who's at fault. Its extra hassle not needed though. I assumed that because ministry were collecting 20% tax (netherlands own vat rate is 21%) I was paying the uk tax upfront, but then they mark the invoice with the full inc vat value and no mention of the tax paid, great....

Tried to tell ministry of pinball they ****ed up and shouldn't be collecting the uk vat if they aren't declaring it correctly on the paperwork, radio silence in reply...

Last edited: