Trying to get a DE flipper plate but it seems postage has gone right up, tried a few. Pinball centre for example want €35, pinball.nl €25

Pinball info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EU delivery prices gone up

- Thread starter M4carp

- Start date

I probably have an old one if it’s any use? Can have a look tomorrow evening

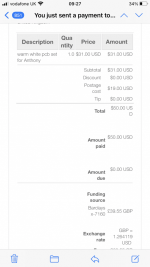

Kinda on the subject but from US:-

Been hosed for some import duty + Handling fee from Royal Mail on 50 USD order with USPS snail mail - not express so total value is way under £139.

This should not be subject to either.

Now regarding the handling fee. Royal Mail should not be charging this unless the item is subject to the following:-

Paid online so will check the labels when it arrives.

Royal Mail even send you the link now on their app if you have any issues:-

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

Been hosed for some import duty + Handling fee from Royal Mail on 50 USD order with USPS snail mail - not express so total value is way under £139.

This should not be subject to either.

Now regarding the handling fee. Royal Mail should not be charging this unless the item is subject to the following:-

- Customs Duty

- Excise Duty

- Import VAT

Paid online so will check the labels when it arrives.

Royal Mail even send you the link now on their app if you have any issues:-

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

Had u prepaid VAT from a seller under the new rules? If not surely 20% VAT on $50 (+postage) + RM admin fee would still be collected, like £15-20Kinda on the subject but from US:-

Been hosed for some import duty + Handling fee from Royal Mail on 50 USD order with USPS snail mail - not express so total value is way under £139.

This should not be subject to either.

Now regarding the handling fee. Royal Mail should not be charging this unless the item is subject to the following:-

They should only be charging the handling fee when doing Border Forces Job by processing packages. Ive just paid for it online as normal. I know this was sent the cheaper way with no insurance.

- Customs Duty

- Excise Duty

- Import VAT

Paid online so will check the labels when it arrives.

Royal Mail even send you the link now on their app if you have any issues:-

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

Thanks, would this still be the case matey if I transacted 6 weeks ago?Had u prepaid VAT from a seller under the new rules? If not surely 20% VAT on $50 (+postage) + RM admin fee would still be collected, like £15-20

Also, I keep getting told the Gov website is ALWAYS up-to-date ?

The Gov bumf says that the *new* rules only apply to orders paid for after 1st Jan 21, so it sounds right that you've copped the *old* payment method. Better than the parcel being returned which some suppliers fear will happen.Thanks, would this still be the case matey if I transacted 6 weeks ago?

Also, I keep getting told the Gov website is ALWAYS up-to-date ?

- Joined

- Jul 21, 2011

- Messages

- 366

Welcome to the new world where you pay VAT and duty if applicable on everything entering UK.Kinda on the subject but from US:-

Been hosed for some import duty + Handling fee from Royal Mail on 50 USD order with USPS snail mail - not express so total value is way under £139.

This should not be subject to either.

Now regarding the handling fee. Royal Mail should not be charging this unless the item is subject to the following:-

They should only be charging the handling fee when doing Border Forces Job by processing packages. Ive just paid for it online as normal. I know this was sent the cheaper way with no insurance.

- Customs Duty

- Excise Duty

- Import VAT

Paid online so will check the labels when it arrives.

Royal Mail even send you the link now on their app if you have any issues:-

https://www.gov.uk/government/publi...tice-143-a-guide-for-international-post-users

David

^^^^ yeah, my order was prior to that deadline matey... I believe. Let’s see what happens when I try this process for kicks:-

https://personal.help.royalmail.com/app/answers/detail/a_id/7208/~/help-with-paying-customs-fees

I’ll complete the BOR286 and let you know how I get on

https://assets.publishing.service.g...ploads/attachment_data/file/946383/BOR286.pdf

https://personal.help.royalmail.com/app/answers/detail/a_id/7208/~/help-with-paying-customs-fees

I’ll complete the BOR286 and let you know how I get on

https://assets.publishing.service.g...ploads/attachment_data/file/946383/BOR286.pdf

Lol.....

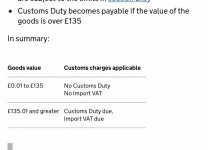

The Royal Mail link above charges up to £135 still for import VAT whereas the gov website latest does not charge import vat up to £135. Ive been charged import VAT and then subsequently the handling fee.

Potentially the issue due to contradictory advice.

The Royal Mail link above charges up to £135 still for import VAT whereas the gov website latest does not charge import vat up to £135. Ive been charged import VAT and then subsequently the handling fee.

Potentially the issue due to contradictory advice.

I had similar in work this morning. Requested an item be picked up in Dec.. Was collected 23rd. However it didnt make the border before 1st Jan... and they now want to charge us for it.... on a 48 hour service...

This is a good article that describes fees for <£135 direct shipped goods https://www.gov.uk/guidance/vat-and-overseas-goods-sold-directly-to-customers-in-the-ukLol.....

The Royal Mail link above charges up to £135 still for import VAT whereas the gov website latest does not charge import vat up to £135. Ive been charged import VAT and then subsequently the handling fee.

Potentially the issue due to contradictory advice.

I think you've been charged correctly for your 2020 placed order.

So do we have to pay the country of origin vat eg EU country’s vat then plus our vat?

Thought it should be zero vat for export.

Im waiting on a pinled flipper board from Germany that was ordered end of December but only entered the Uk yesterday, I paid German tax so will be interesting to see what happens.

Edit

Just read the link, can see why they don’t want to deal with us

Thought it should be zero vat for export.

Im waiting on a pinled flipper board from Germany that was ordered end of December but only entered the Uk yesterday, I paid German tax so will be interesting to see what happens.

Edit

Just read the link, can see why they don’t want to deal with us

Not entirely sure to be honest......This is a good article that describes fees for <£135 direct shipped goods https://www.gov.uk/guidance/vat-and-overseas-goods-sold-directly-to-customers-in-the-uk

I think you've been charged correctly for your 2020 placed order.

I think because it was around 6 weeks ago and it does mention this at the end of the article:-

‘If a seller receives payment for an order before 11pm on 31 December 2020 and dispatches the item after that time, these rules will not apply’.

Seller in my case received payment way before and despatched item in advance so.....

Just the principle of the matter, I guess they just hope peeps just pay up as usual.

^^^^ yeah, my order was prior to that deadline matey... I believe. Let’s see what happens when I try this process for kicks:-

https://personal.help.royalmail.com/app/answers/detail/a_id/7208/~/help-with-paying-customs-fees

I’ll complete the BOR286 and let you know how I get on

https://assets.publishing.service.g...ploads/attachment_data/file/946383/BOR286.pdf

I've had similar, PU order sent out 14th December, allegedly out for delivery 21st December, ended up back in Germany and now they won't post it out!

So do we have to pay the country of origin vat eg EU country’s vat then plus our vat?

Thought it should be zero vat for export.

Im waiting on a pinled flipper board from Germany that was ordered end of December but only entered the Uk yesterday, I paid German tax so will be interesting to see what happens.

Edit

Just read the link, can see why they don’t want to deal with us

In fact you are spot on.... Local VAT should not be charged for... however they should charge VAT at 20%.

I completely get where companies are coming from (all the additional admin etc)... however i guess it's a trade off between how much they would loose Vs the additional hassles..

I'm not sure what you're disputing. If you ordered/paid $50 in 2020 then RM should collect approx £15 upon delivery. In the 2021 regime the seller should collect the 20% VAT = $10 upon payment which didn't happen..Just the principle of the matter, I guess they just hope peeps just pay up as usual.

I'm going cross eyed, but yeah its £13.50 extra. When I checked the Gov link above that RM had on their app for article 143, it mentioned the zero amount to pay up to £135 so just assumed I was stuffed. So, this is charged under the old regime? - I think I get it now, just confusing when they gave the link to the charges.I'm not sure what you're disputing. If you ordered/paid $50 in 2020 then RM should collect approx £15 upon delivery. In the 2021 regime the seller should collect the 20% VAT = $10 upon payment which didn't happen..

Last edited:

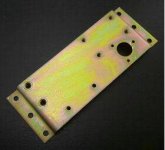

DohThanks mate, would appreciate that. It’s the right hand side one.

Someone fitted it back in with strips of metal holding it together.

View attachment 129503

wrong side, I’ll get back in tomorrow or over the weekend.

should have the other side as well @M4carp

biglouieuk

Site Supporter

Pinball Center now charge €35EUR for UPS shipping, up from €15EUR before new year.

Their prices on their website include vat. Presumably German VAT

Why the 20eur hike on the entire order postage?

Their prices on their website include vat. Presumably German VAT

Why the 20eur hike on the entire order postage?

D

Deleted member 2463

Just scum trying to take advantage I guess but frankly I would order a poster of a beardy guy with his cock out from those bozos.

My wife’s company send oxygen masks and medical devices directly to French hospitals. An entire shipment was returned yesterday as UPS apparently now require the invoices attached to the customs forms in English as well as the French that they are actually raised and processed in.

UPS now charge £5 extra for customs paperwork per parcel and that’s on top of the big price rises last year as well as the COVID surcharge.

Each delivery has had now doubled or trebled in cost, aside from the extra time and manpower to process the customs paperwork. They are not allowed by French law to charge the hospitals postage so are now looking at making a loss on each transaction.

On top of the new rules of origin regulations it seems this might be the final straw as the price increases now required make them uncompetitive compared with other suppliers.

Their just in time manufacturing has gone to tits too as containers of raw materials get diverted to, and stuck in, the wrong port / country.

UPS now charge £5 extra for customs paperwork per parcel and that’s on top of the big price rises last year as well as the COVID surcharge.

Each delivery has had now doubled or trebled in cost, aside from the extra time and manpower to process the customs paperwork. They are not allowed by French law to charge the hospitals postage so are now looking at making a loss on each transaction.

On top of the new rules of origin regulations it seems this might be the final straw as the price increases now required make them uncompetitive compared with other suppliers.

Their just in time manufacturing has gone to tits too as containers of raw materials get diverted to, and stuck in, the wrong port / country.

biglouieuk

Site Supporter

Madness. I had quite a few requests from the US and Europe for the Bride of Pinbot, replacement face guides.

Because of shipping costs on such a.small item, I found pinheads in those countries with lasers and got them to cut em and fire them out.

Stick the ridiculous tax and shipping up your 4R5E

Because of shipping costs on such a.small item, I found pinheads in those countries with lasers and got them to cut em and fire them out.

Stick the ridiculous tax and shipping up your 4R5E

Thank you, really appreciate your helpDoh

wrong side, I’ll get back in tomorrow or over the weekend.

should have the other side as well @M4carp

Yeah, I bought a plastic set (PC) for good money that wasn’t good at all - only choice. Waiting for another set of slingshots because holes were so big the nuts went through!Just scum trying to take advantage I guess but frankly I would order a poster of a beardy guy with his cock out from those bozos.

Then asking me to send in parts of my old set to fix the issues with the one they were selling with no offer of postage costs and there they are asking us €35 now!

I doubt the new slingshots will ever arrive

Some guys in the states cancelled their order when they saw mine and my complaints. That made me feel good.

My pinled flipper board arrived yesterday from Germany with no charges, ordered late December.

Asiapinball

Site Supporter

M4Carp PM me if Biglan cant help out as I loads of these as I parted out 3 Baywatch and 4 Batman Forever some years ago.Thank you, really appreciate your help

Will do, thanks very much.M4Carp PM me if Biglan cant help out as I loads of these as I parted out 3 Baywatch and 4 Batman Forever some years ago.